Pros and cons of debit cards

Payment cards called debit cards are connected to your checking account. When you make a transaction with a debit card, the funds are immediately deducted from your checking account balance.

Debit cards are used by 87% of Americans for various purposes, including internet shopping and bill payment.

Debit cards allow you to make purchases without carrying cash, but you can also take money out of your checking account using them.

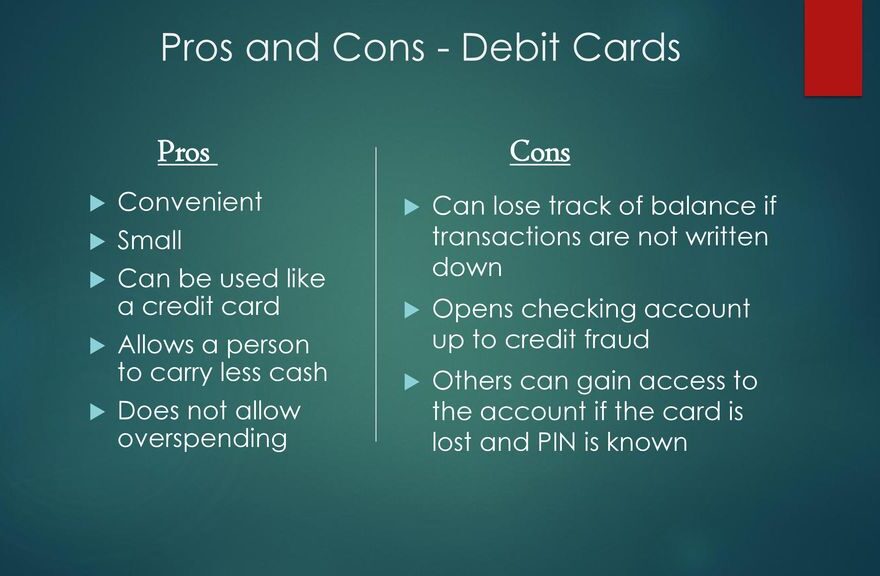

Let’s examine some of the benefits and drawbacks of debit cards.

Advantages of debit cards

Prevention of debt

Debit cards don’t result in debt, which is one of their benefits. Because they are using money that is not theirs, credit card users might quickly lose track of their expenditures.

Using a debit card restricts spending to the available balance in your checking account at any one time.

For persons with uncontrollable spending habits or young people who may be discovering how to handle their finances for the first time, this can be useful.

No yearly costs

A big bonus when weighing the benefits and drawbacks of debit cards is the absence of yearly fees. Debit card users are exempt from annual fees and maintenance charges, unlike credit card users.

Many financial organizations, such as Texas Tech Credit Union, even provide customers with debit cards with extra benefits, such as rewards for up to a certain amount of spending.

Debit cards give users fast access to cash from ATMs connected to their banking institutions, but many will also cover fees associated with using unconnected ATMs.

Easy to obtain

Because credit cards frequently demand a long credit history or good credit score, someone with a short or bad credit history may have trouble getting one.

However, anyone with a checking account is eligible to receive a debit card, therefore having bad credit or no credit will not preclude someone from doing so.

Drawbacks of debit cards

Your credit score won’t improve with debit cards.

Customers cannot establish good credit through the use of debit cards, in contrast to credit cards. A negative balance in your checking account or an unexpected overdraft, however, can hurt your credit record and score.

Employers and landlords are likely to check your credit score even if you are not currently trying to buy a significant item (such as a car or a house).

A few failing grades can give them the idea that you don’t care about your finances.

Default fees

You must keep a watchful eye on your spending when using a debit card. You can incur overdraft or insufficient funds fees, which can cost up to $35 if you spend more than what is available in your checking account.

If you don’t regularly check your balance, it can be incredibly simple to spend more money than you have.

Sign up for banking notifications to keep track of your expenses and account balances, and log into your online account at least once per week to review purchases and statements to help you better manage your spending.

Erroneous charges

It might be dangerous to use your debit card to make online purchases, and it can be troublesome if you misplace your debit card.

Some banks don’t compensate customers for fraudulent debit card charges, in contrast to credit card firms.

Additionally, whereas credit card companies frequently reimburse erroneous charges right away, a bank may require up to two weeks to recover lost money.

Your ability to pay your costs or payments could be affected, and your credit score might also suffer.

Thanks for visiting US Map of State